Shopify tax calculation

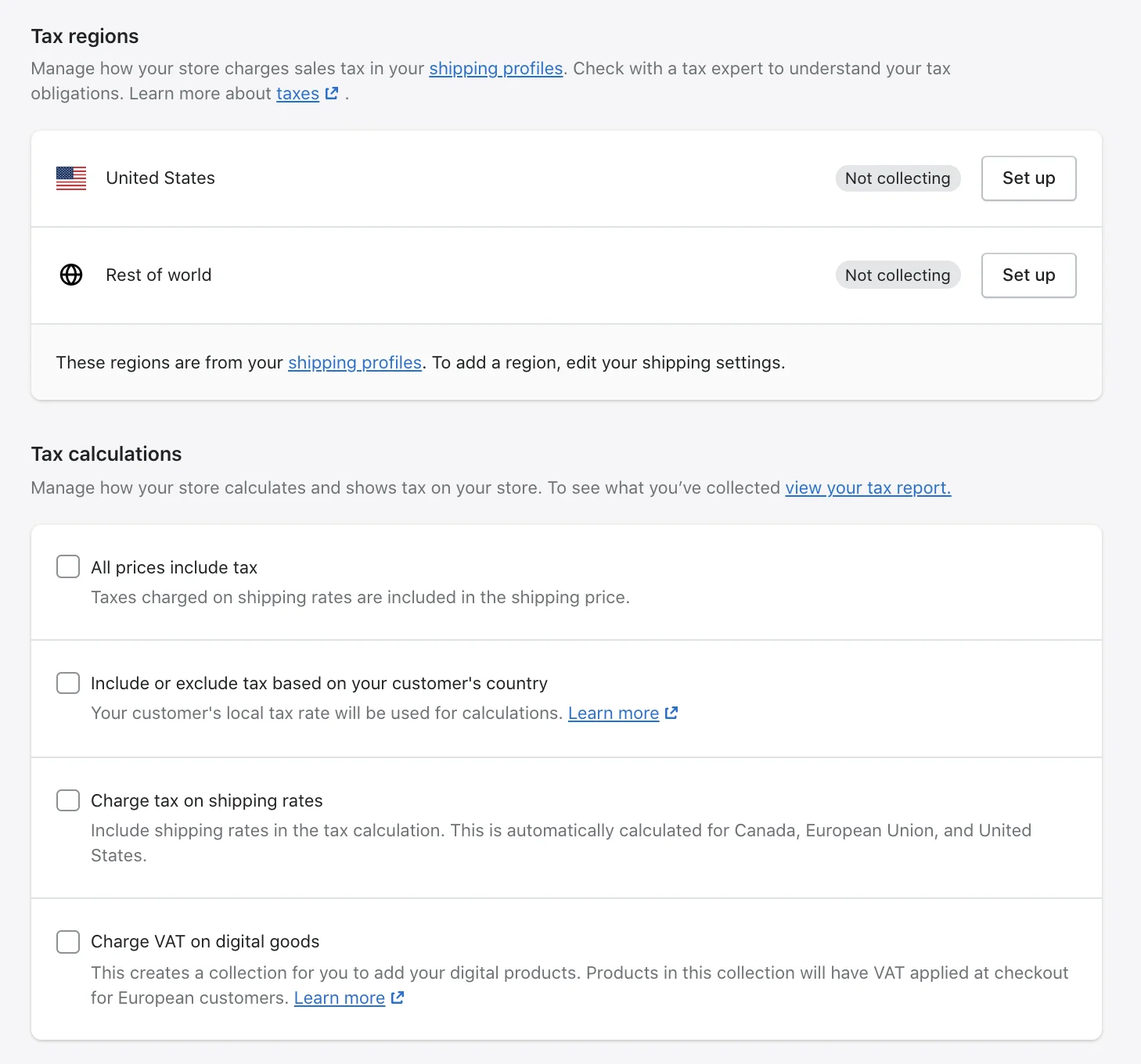

Zonos Duty and Tax. After youve determined where you need to charge tax in the United States you can set your Shopify store to automatically manage the tax rates used to calculate sales on taxes and set.

Shopify Calculating California Sales Tax Incorrectly Shopify Community

Calculate and collect the total landed cost for international orders.

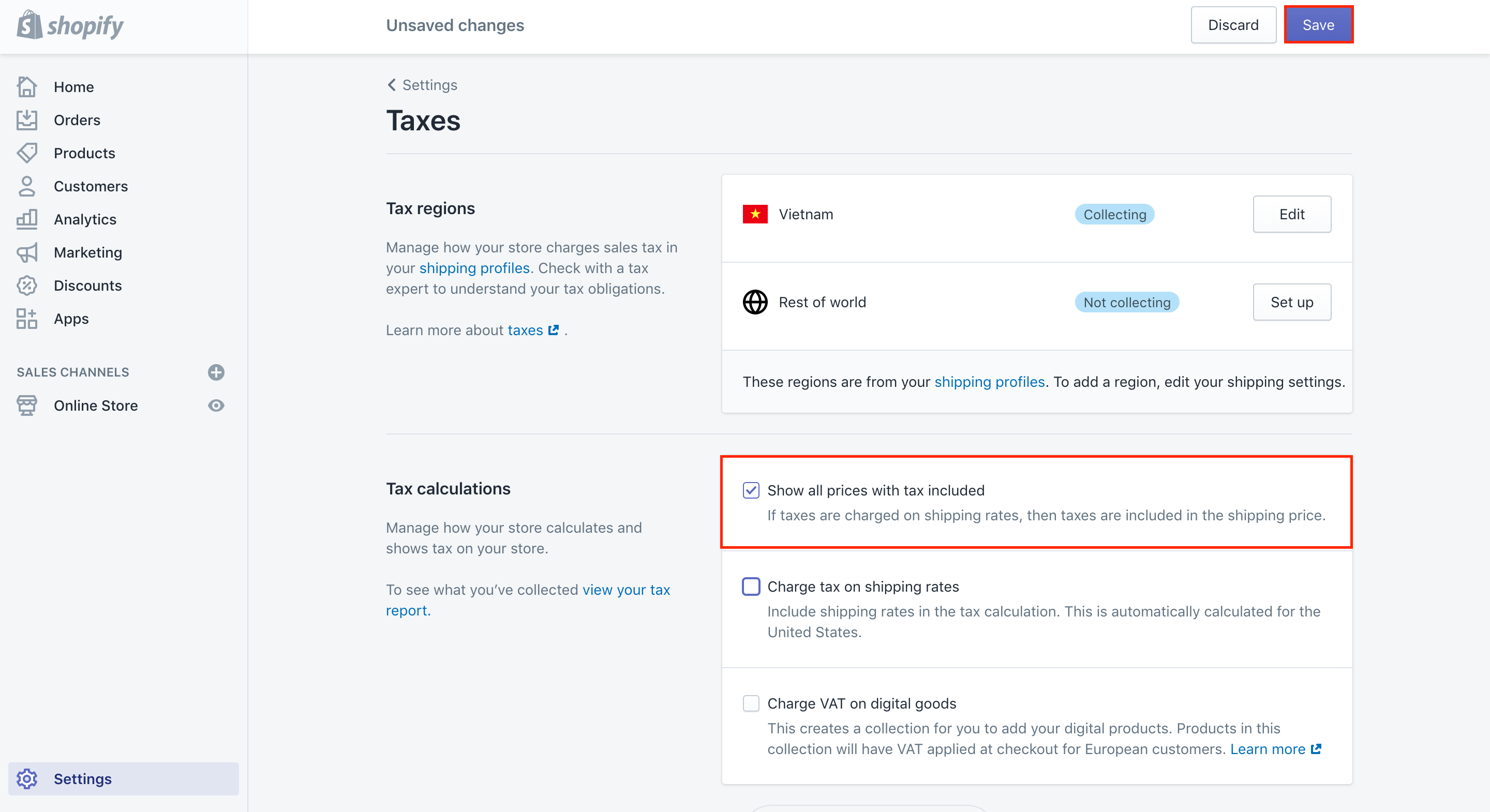

. Ad Maximize your potential and grow your business with unlimited capital aligned to your plan. As a Shopify business owner we help you automatically handle most tax calculations. States set a rate and then localities can add a percentage on top of those rates.

Shopify uses default sales tax rates from around the world and theyre updated regularly. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and.

Tax rates are provided by Avalara and updated. The Sales Tax charged should have been. Spend less time on sales tax with a free trial of the Avalara AvaTax plugin for Shopify.

Ad Leading Class Tax Tools and Technology to Help Businesses Stay Competitive. As a Shopify business owner we help you automatically handle most tax calculations. Our Premium Calculator Includes.

I currently have the auto tax calculator. Ad Maximize your potential and grow your business with unlimited capital aligned to your plan. Shopify tax calculation Sabtu 03 September 2022 Edit.

Lets plan your success. For example in the 90210 zip code the tax rate is the 65. Lets plan your success.

Calculate the amount of sales tax and total purchase amount given the price of an item and the sales tax rate percentage. Look up 2022 sales tax rates for Goldsboro Maryland and surrounding areas. Important Note on Calculator.

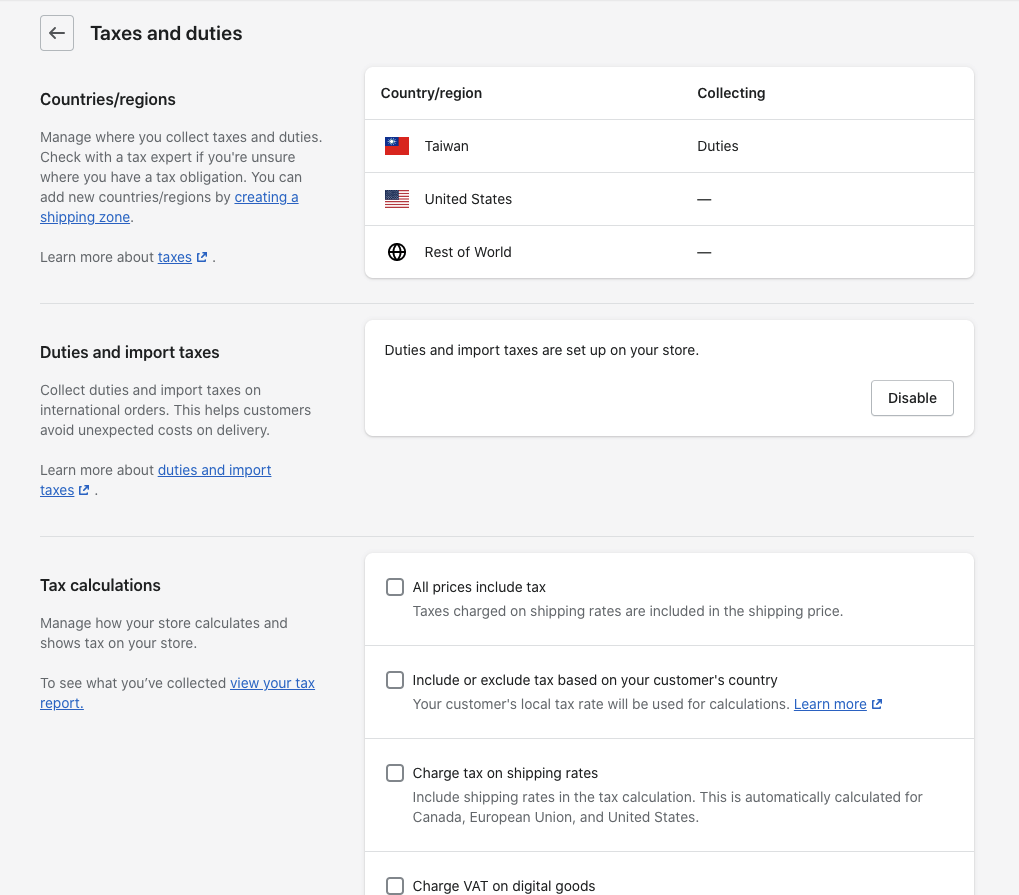

A key feature of Shopify Markets available to Shopify Advanced and Plus merchants is a native Duties Import Taxes calculator which lets merchants calculate and. HS codes are recommended but not required to get started. Keep more profit while reducing risk and stress.

Learn Why Financial Services Companies are Making Changes to Their Tax Operating Model. A note on sales tax rates. Keep more profit while reducing risk and stress.

Our Premium Calculator Includes. 050 Rohnert Park City. Tax rates are provided by Avalara and updated monthly.

Calculate sales tax automatically with an Avalara AvaTax plugin for Shopify. So we are registered in California and if we shipped to different states in California. Shopify Basic not supported.

Hello Can you please update on which base tax is calculated within accountings in a state.

What Is The Formula For Tax Calculation On Shopify Orders Shopify Community

How To Charge Shopify Sales Tax On Your Store Sep 2022

Shopify S Sales Tax Liability And Nexus Dashboard Results Explained Taxvalet

Rich And User Friendly Features Of Opencart Ecommerce Website Development Opencart Ecommerce

Cost Of Equity Capital Asset Pricing Model Capm In 2022 Capital Assets Equity Capital Cost Of Capital

How To Charge Taxes On Shopify Store

How To Use An Excel Spreadsheet Excel Spreadsheets Excel Spreadsheets Templates Spreadsheet Template

How To Charge Shopify Sales Tax On Your Store Sep 2022

How To Charge Shopify Sales Tax On Your Store Sep 2022

Shopify Duties And Taxes Support Shopify Markets Easyship Support

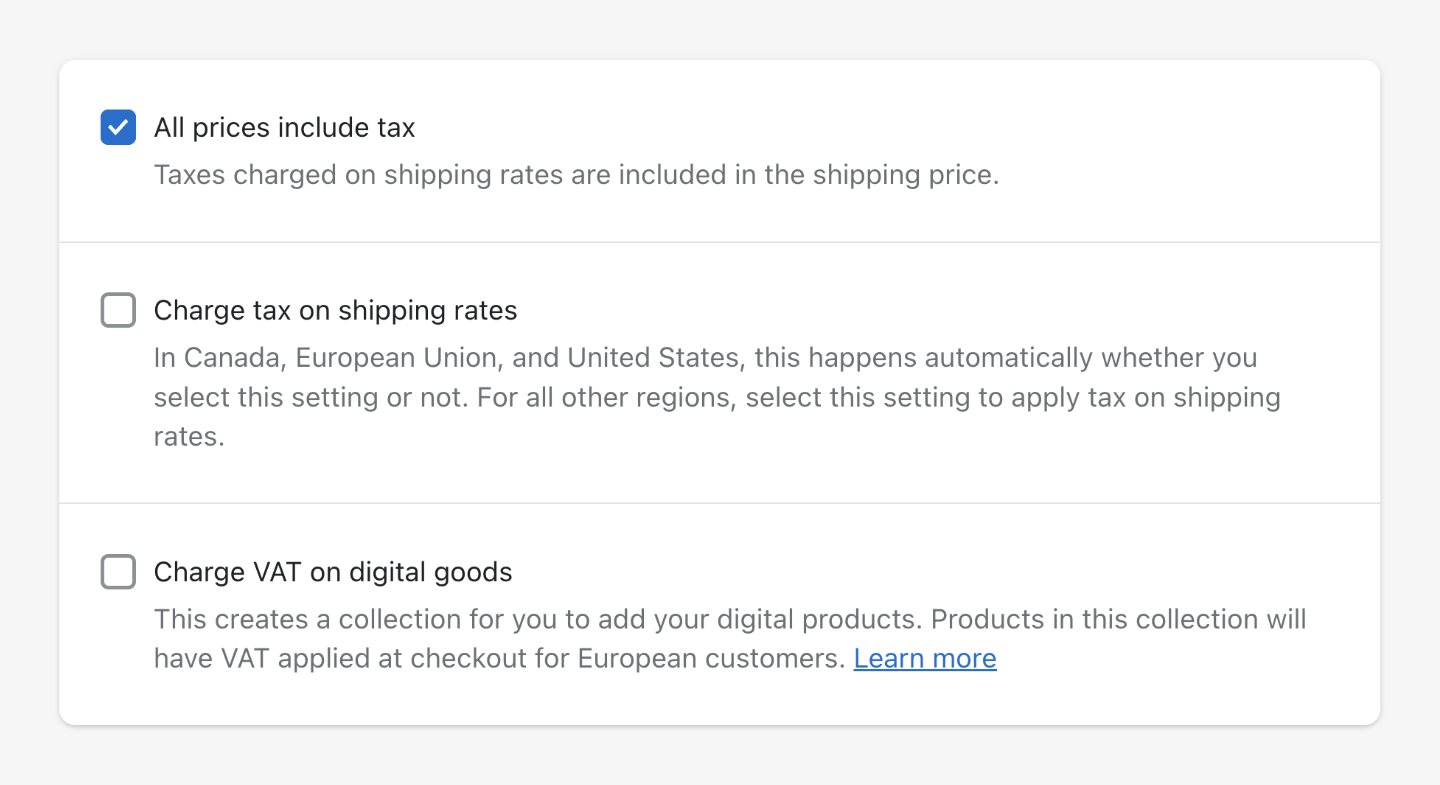

Include Or Exclude Tax From Product Prices In Shopify Sufio For Shopify

Shopify Calculating California Sales Tax Incorrectly Shopify Community

Re Different Taxes On Shipping Shopify Community

Pin On Shopify

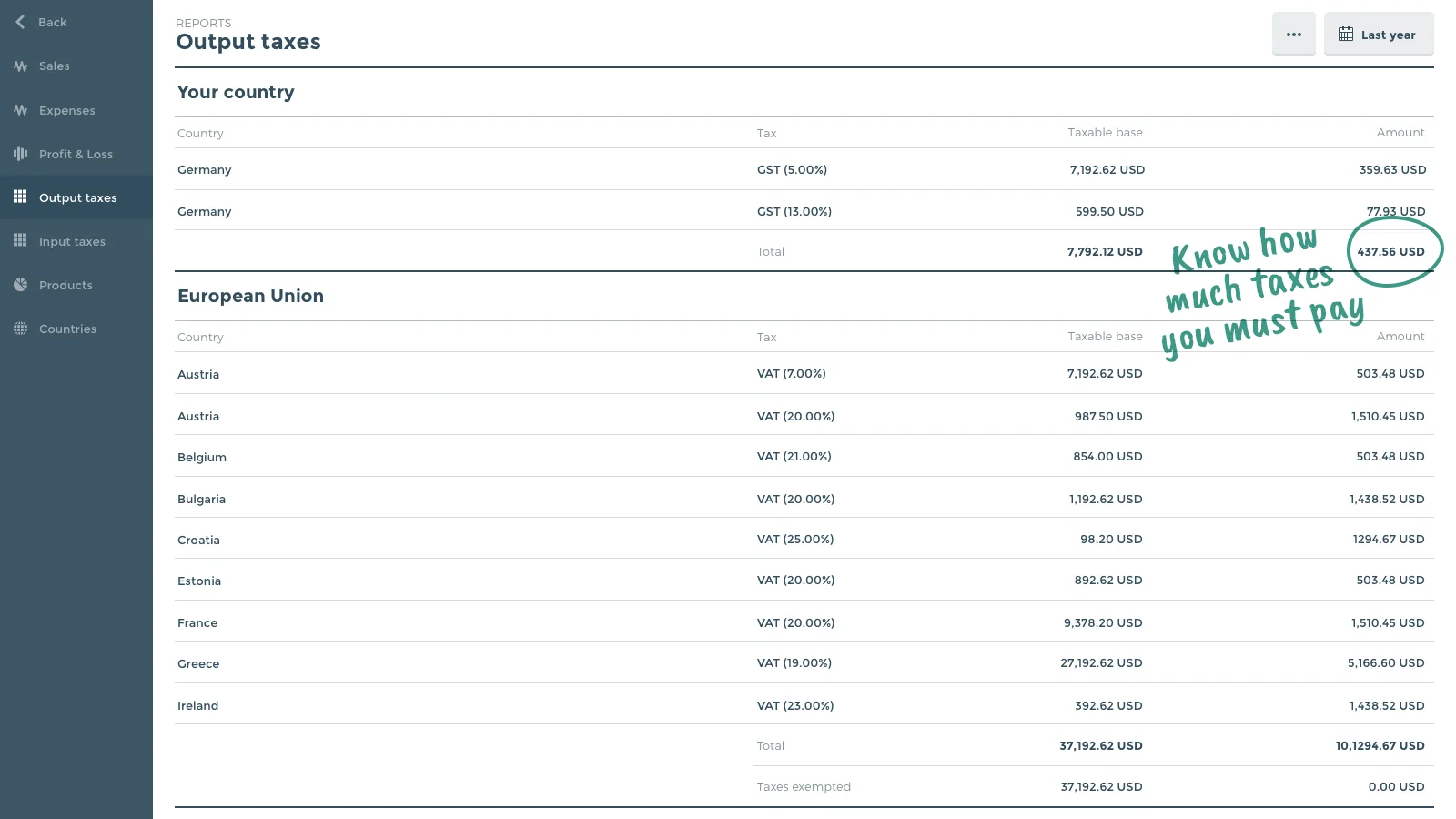

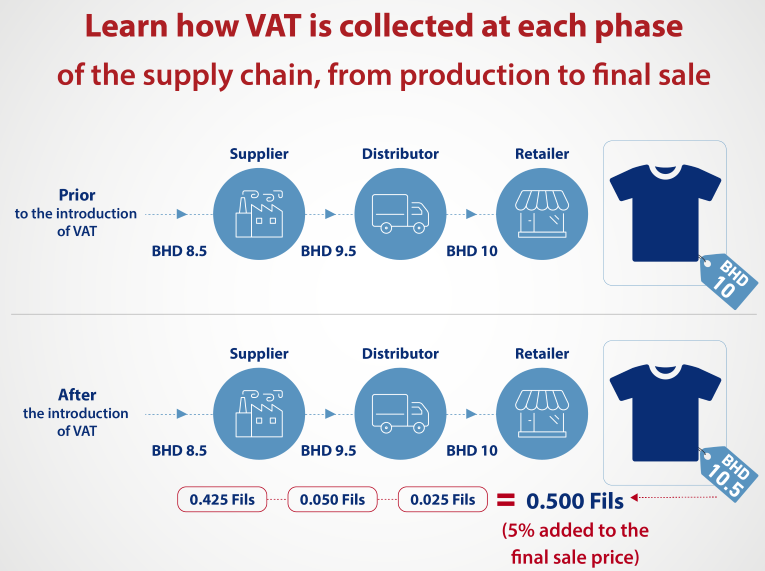

Tax Calculation For Online Dealers On The Shopify Platform In Europe

Rule Of 69 Meaning Benefits Limitations And More Financial Life Hacks Learn Accounting Accounting Basics

How To Charge Shopify Sales Tax On Your Store Sep 2022